WANDA CINEMAS will change hands, resume trading "one word" daily limit! The transferee has produced many explosive TV dramas such as nirvana in fire and legend of miyue.

On December 13th, WANDA CINEMAS (SZ002739) resumed trading at a daily limit. As of press time, WANDA CINEMAS reported 13.7 yuan/share, an increase of 10.04%, with a market value of 29.86 billion yuan.

On the evening of December 12, WANDA CINEMAS announced that on December 12, 2023, WANDA CINEMAS Co., Ltd. (hereinafter referred to as "the company" and "WANDA CINEMAS") is the indirect controlling shareholder of Beijing Wanda Cultural Industry Group Co., Ltd. (hereinafter referred to as "Wanda Cultural Group") and its wholly-owned subsidiary Beijing Hengrun Enterprise Management Development Co., Ltd. (hereinafter referred to as "Beijing Hengrun"), the actual controller of the company, Mr. Wang Jianlin and Shanghai Ruyi Investment Management Co., Ltd. (hereinafter referred to as "Ruyi Investment"). Signed the Equity Transfer Agreement on Beijing Wanda Investment Co., Ltd. (hereinafter referred to as the Equity Transfer Agreement) to transfer 51% equity of Beijing Wanda Investment Co., Ltd. (hereinafter referred to as Wanda Investment) to Ruyi Investment (hereinafter referred to as the transaction).

As of the disclosure date of this announcement, Wanda Investment holds 435,873,762 shares of WANDA CINEMAS, accounting for 20% of the company’s total share capital, and is the controlling shareholder of the company. If the above transaction is finally implemented,Ruyi Investment will hold 51% equity of Wanda Investment, and Mr. Ke Liming will be the actual controller of Ruyi Investment, and will indirectly control 20% equity of WANDA CINEMAS through Wanda Investment. The actual controller of the company will be changed from Mr. Wang Jianlin to Mr. Ke Liming.

Image source: every original

On December 12, 2023, Wanda Culture Group, Beijing Run and Mr. Wang Jianlin signed the Equity Transfer Agreement with Ruyi Investment, intending to transfer their 20%, 29.8% and 1.2% equity of Wanda Investment (holding 51% equity of Wanda Investment in total) to Ruyi Investment, with a total transfer price of RMB 2.155 billion.

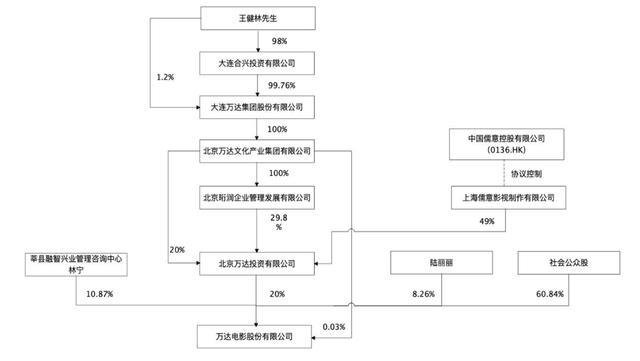

Prior to this transaction, Wanda Investment, the controlling shareholder of the company, held 20% of the shares of the company, and Wanda Culture Group, Beijing Luorun and Mr. Wang Jianlin held 51% of the shares of Wanda Investment. Mr. Wang Jianlin indirectly controls 30.9% of the equity of WANDA CINEMAS through Wanda Investment, Wanda Culture Group, Shenxian Rongzhi Xingye Management Consulting Center (Limited Partnership) and Ms. Lin Ning. The actual controller of the company is Mr. Wang Jianlin. Before the change, WANDA CINEMAS’s shareholding control relationship is as follows:

Prior to this transaction, Mr. Ke Liming held 16.34% of the total share capital of China Ruyi Holdings Co., Ltd. (hereinafter referred to as "China Ruyi"), and Shanghai Ruyi Film and Television Production Co., Ltd. (hereinafter referred to as "Ruyi Film and Television"), which was controlled by China Ruyi through an agreement, held 49% of Wanda Investment.

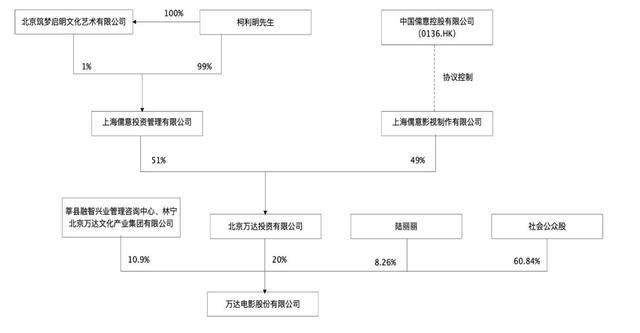

After this transaction,The controlling shareholder of the company is still Wanda Investment, and Ruyi Investment holds 51% of Wanda Investment.Ruyi Investment is a wholly-owned company owned by Mr. Ke Liming, who indirectly controls 20% equity of WANDA CINEMAS through Ruyi Investment, and the actual controller of the company will be changed to Mr. Ke Liming.

In addition, China Ruyi Film and Television, which is controlled by Ruyi through an agreement, holds 49% of Wanda Investment, and Mr. Ke Liming also holds 16.34% of the total share capital of China Ruyi.

After the change, the shareholding control relationship of WANDA CINEMAS is as follows:

After this transaction,Mr. Wang Jianlin indirectly controls 10.9% equity of WANDA CINEMAS through Wanda Culture Group, Shenxian Rongzhi Xingye Management Consulting Center (Limited Partnership) and Ms. Lin Ning.

According to the announcement, Mr. Ke Liming, male, born in April 1983, is of China nationality and has no permanent residency abroad, with a postgraduate degree. He is currently the executive director and chairman of China Ruyi and the CEO of Pumpkin Films Limited. As an investor and producer, Mr. Ke Liming once led and invested in films such as Keep You Safe, Exchange Life, Moon Man, Hello Li Huanying, A Little Red Flower, Animal World, Sewing Machine Band, never gone, To Our Dying Youth, The Old Boy Raptors Across the River, Old Chinese Medicine Doctor, Old Pub, Frontier of Love and No War in Peiping.

Since the beginning of this year, Wang Jianlin, the founder of Wanda Group, has frequently "sold" its equity and reduced its assets. On July 10th, Wanda Investment signed a share transfer agreement with Lu Lili, intending to transfer its 180 million shares of WANDA CINEMAS to Lu Lili, with a total transfer price of about 2.173 billion yuan. Lu Lili’s most well-known identity is the "proprietress" of Oriental wealth. Then, on July 18th, Wanda Investment again plans to transfer its 177 million shares of WANDA CINEMAS unrestricted shares to Shenxian Rongzhi Xingye Management Consulting Center (Limited Partnership) at a transfer price of 1.317 yuan/share, with a total transfer price of about 2.336 billion yuan.

Wang Jianlin once made no secret of his ambition for the cultural industry. Many years ago, when faced with the news that Disneyland had settled in Shanghai, he boldly declared that it would be difficult for Disney to make a profit in the next 20 years. He clearly realized that China’s real estate industry has developed for more than 20 years, and in another 15-20 years, this industry may gradually shrink. In order to ensure the sustainable development of Wanda, he understands that the company must turn to diversified fields such as culture and tourism.

In order to realize this transformation, Wanda carried out a major overseas merger and acquisition as early as 2012, and acquired AMC Entertainment Holding Company, the second largest cinema in the United States, which was the first overseas merger and acquisition in China film history. Since then, Wanda Cinema has successively launched a fixed-income plan since July 2015, and plans to acquire 100% equity of Hoyts, the second largest cinema in Australia, and 100% equity of Muwei Fashion and Chongqing Shimao Cinema Management Company, a domestic film data company.

Wanda also owns its own listed company, wanda cinema line, which is in the leading position in the domestic industry and is regarded as an important quality asset of Wanda Culture Group by the outside world. However, affected by the epidemic situation in recent years and other factors, WANDA CINEMAS has also experienced some difficulties. According to the financial report data, in 2019 and 2020, the company lost 4.729 billion yuan and 6.669 billion yuan respectively. Although it achieved a slight profit in 2021, it fell into a loss again in 2022, with a net profit loss of 1.923 billion yuan.

Today, Wang Jianlin bid farewell to the original film and television dream.

"Before the epidemic, Wang Jianlin expressed his dissatisfaction with WANDA CINEMAS at the year-end summary meeting for two consecutive years. After the annual party, he will come to our floor, which impressed me deeply. He said in a bad tone that the cinema earned less and the company didn’t keep idle people. The film industry as a whole is only tens of billions a year, which can’t help the big group. " The employee recalled Wang Jianlin’s deep impression on the film and television business.

WANDA CINEMAS’s third quarterly report data shows that in the first three quarters of this year, WANDA CINEMAS’s operating income was about 11.347 billion yuan, an increase of 46.98% year-on-year;The net profit attributable to shareholders of listed companies is about 1.114 billion yuan.The net profit attributable to shareholders of listed companies after deducting non-recurring gains and losses is about 1.103 billion yuan; The net cash flow from operating activities was about 3.796 billion yuan, up 127.69% year-on-year.From January to September 2023, the company’s domestic cinemas achieved a box office of 6.22 billion yuan (excluding service fees)., an increase of 67.6% year-on-year, an increase of 5.2% over the same period in 2019; The number of people watching movies was 150 million, a year-on-year increase of 68.7% and an increase of 3.7% over the same period in 2019.

By September 30th, 2023, the company had 877 cinemas and 7,338 screens in China, including 709 directly operated cinemas and 6,159 screens, and 168 light assets cinemas and 1,179 screens. In the first three quarters, the company’s cumulative market share was 16.5%.

According to public information, Shanghai Ruyi was established in 2013, mainly engaged in the production and operation of radio and television programs and film distribution business. It is a controlled structural entity with 100% actual rights and interests in China Ruyi.The company has produced Hi, Mom’s To Youth, nirvana in fire, legend of miyue, Sewing Machine Band, A Little Red Flower and many other explosive TV dramas.Previously, among the four cornerstone investors introduced by Lehua Entertainment IPO, Sun Mass Energy, a wholly-owned subsidiary of China Confucianism and Italy, subscribed for $7.9 million in offering shares.

Image source: Company official website

It is worth mentioning that the largest shareholder of China Confucianism is Tencent. Including the introduction of China Confucianism, Wanda recovered 6.766 billion yuan in July through three equity transfers and the disposal of WANDA CINEMAS and Wanda’s investment equity.

National business daily Comprehensive WANDA CINEMAS Announcement, Shanghai Confucianism, official website and national business daily (Reporter Bi Yuanyuan)

Disclaimer: The contents and data in this article are for reference only and do not constitute investment advice. Please verify before use. Operate accordingly at your own risk.

national business daily