Xiaomi automobile "life and death moment", Lei Jun wants to save every grain of "rice"

Lei Jun is saving every grain of millet.

On July 10th, Xiaomi canteen issued a notice saying that disposable tableware and packing bags will no longer be provided free of charge from now on, but will be provided with disposable tableware: disposable chopsticks 0.1 yuan/pair, disposable packing bags 0.1 yuan/piece, and disposable packing boxes will be divided into 0.5 yuan and 1 yuan according to their sizes.

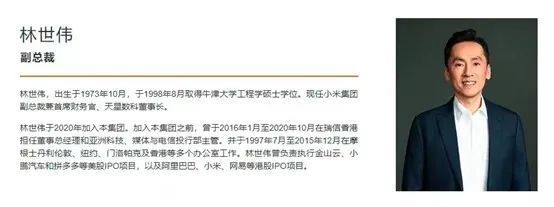

On July 8, according to Sina Technology, Xiaomi announced the establishment of a special group to reduce costs and increase efficiency, with Lin Shiwei, CFO of the group, as the team leader.

It seems that Xiaomi will continue to vigorously promote cost reduction and efficiency improvement.

It is not difficult to understand that "the moment of life and death", Lei Jun is no longer careful to live, and the bitter may be Xiaomi employees.

The sense of crisis spreads, and the cost is reduced and the efficiency is increased.

According to reports, Xiaomi’s cost reduction and efficiency enhancement special group will report to the Group Management Committee, with Lin Shiwei, CFO of the Group, as the team leader, Pan Jiutang, Liu Wei and Zhang Jianhui, special assistants of the Group CEO, as the team members, and Sun Qian, vice president of the Group Finance Department, as the secretary-general to carry out daily work.

At the end of January this year, Xiaomi Group established two professional committees, namely, the operation management committee and the human resource management committee, among which the operation management committee is mainly responsible for the overall management of business strategy, planning, budgeting, implementation and daily business management.

The committee consists of 12 members, with Xiaomi CEO Lei Jun as the director personally, Xiaomi President Lu Weibing as the deputy director, and Pan Jiutang as the secretary-general. The other members include Adam Gao, president of mobile phone department, Zhang Feng, president of household appliances department, Chen Bo, general manager of ecological chain department, Ma Qiang, general manager of Internet department, and other Xiaomi group executives and business department heads.

In the internal staff letter, Lei Jun emphasized that the establishment of the two committees is "a far-reaching change in the history of corporate governance".

Stepping into 2023, Xiaomi is quietly changing.

"Now is the moment of life and death, and we must find the point of reducing costs and increasing efficiency."According to Sina Technology, citing people familiar with the matter, Lei Jun was so outspoken at an internal executive meeting.

In my impression, Lei Jun made similar remarks in 2016, when Xiaomi suffered a decline in mobile phone sales. The difference is that Lei Jun was full of confidence that year and firmly believed that Xiaomi had bottomed out and was about to rebound.

The sense of crisis spread.

On July 6th, 2023, at Xiaomi & Shunwei Eco-investment Conference, Lei Jun said that the core reason for the closure of many startup companies was that there was no money in their accounts. He suggested that the invested companies "keep an eye on cash, reduce costs and increase efficiency" in order to spend the economic cycle of that year.

Judging from the data of the first quarterly report of this year, in Xiaomi Group, Lei Jun has indeed vigorously practiced cost reduction and efficiency improvement.

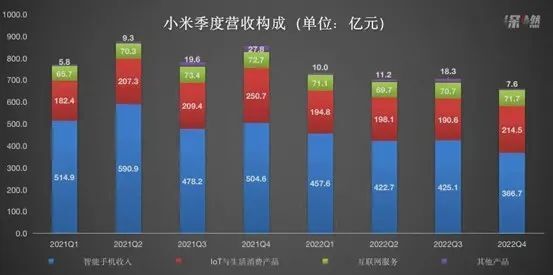

According to the financial report data, during the reporting period, Xiaomi achieved revenue of 59.5 billion yuan, down 18.9% year-on-year; The adjusted net profit exceeded 3.2 billion yuan, a year-on-year increase of 13.1%; At the same time, sales and promotion expenses decreased by 21.9% year-on-year, administrative expenses decreased by 8.8% year-on-year, and the overall gross profit margin reached 19.5%, a record high.

Revenue declined for five consecutive quarters.

Revenue has fallen for five consecutive years, and it is difficult for mobile phones to climb high. Xiaomi is under pressure.

According to the first quarterly report of this year, the revenue of smartphone business, which accounted for 58.8%, was 35 billion yuan, a decrease of 23.6% compared with 45.8 billion yuan in the first quarter of 2022.

This is mainly due to the double drop in the volume and price of mobile phones.

In the first quarter, the shipment of Xiaomi smartphones was only 30.4 million units, down by 21.1% compared with the same period of last year, and a difference of 22.5 million units from the historical high of 52.9 million units in the second quarter of 2021, which almost stopped.

This decline is also far more than the broader market. According to Canalys data, global smartphone shipments decreased by 13.3% year-on-year to 269.8 million units in the first quarter of 2023, the lowest first quarter shipment since 2014.

In the context of increasingly fierce competition in the mobile phone stock market, this contrast is even more severe.

According to IDC data, in the first quarter of 2023, China’s smartphone market shipped about 65.44 million units, down 11.8% year-on-year. From the perspective of TOP5 brand, OPPO, Apple, vivo, Glory and Xiaomi all experienced year-on-year decline.

The expected rebound after the epidemic did not appear, consumer confidence was insufficient, the replacement cycle was prolonged, and various tricks were used to seize the limited market. As a result, Xiaomi was under more pressure.

In addition, the ASP (average selling price) of Xiaomi smartphones decreased by 3.1% year-on-year to 1,151.6 yuan per smartphone in this quarter.

Obviously,This is far from the high-end expected by Xiaomi.According to Xiaomi’s definition in the financial report, high-end smartphones in Chinese mainland are models priced at 3000 yuan and above.

Affected by the downturn of mobile phone business, Xiaomi’s revenue performance was average. In this quarter, it decreased by 18.9% year-on-year to 59.48 billion yuan, which is the five consecutive quarters of revenue decline of Xiaomi since the first quarter of 2022, and the net profit declined for four consecutive quarters.

It is worth mentioning that the performance of the 618 promotion season, which was hoped by smartphone brands, was slightly bleak.

According to the statistics of research institute Counterpoint, during the promotion season of June 18, 2023 in China (June 1 -18), the sales volume of smartphones dropped by 8% year-on-year, among which vivo won the sales champion, with a market share of 18.2%, while Apple, the second runner-up, took 17.9%, and Glory and Xiaomi tied for the third place with 15.4%.

Judging from the stock price performance, the share price of Xiaomi Group’s Hong Kong stocks has fluctuated lower this year.

The data shows that since the end of May, Xiaomi has frequently repurchased shares. According to statistics,A total of about 47.2 million shares were repurchased, involving more than HK$ 500 million, and Xiaomi’s share price showed no signs of stopping falling.

However, after hitting the low level of the year on June 25, it began to continue to rise. On July 11th, Xiaomi Group announced that it would buy back 2.3 million shares that day at a cost of about HK$ 25 million.

Make a big car,

Will Lei Jun get what he wants?

While reducing expenditure, we should also open up sources.

As the smartphone business declines, Xiaomi Group hopes to break through in other fields, such as building cars.

On March 30, 2021, Xiaomi officially announced to enter the smart electric vehicle industry. 500 days later, in August 2022, Xiaomi first announced the research and development progress of Xiaomi’s autonomous driving technology.

"The goal of Xiaomi’s automatic driving is to enter the first camp of the industry in 2024",At this year’s annual speech conference, Lei Jun spoke frankly about Xiaomi’s goal of building a car, and revealed that the first phase of Xiaomi’s autonomous driving technology planned 140 test vehicles, which will be tested nationwide one after another.

At the same time, Lei Jun wrote this goal into the financial report: for the car-making business, the mass production plan for the first half of 2024 will remain unchanged.

Lei Jun described Xiaomi’s car-making as: it was not a momentary fever, but "one of the most important decisions in the history of Xiaomi’s development, which was the result of repeated argumentation and careful decision-making by the company’s management".

In order to enter the market quickly, Xiaomi threw money wildly.

The financial report shows that in 2022, Xiaomi invested 3.1 billion yuan in new businesses such as smart electric vehicles; In the first quarter of 2023, the R&D expenditure of this business was 1.1 billion yuan.

Xiaomi proudly declared: It is estimated that the total R&D investment in 2023 will exceed 20 billion yuan. According to the proportion of the total R&D expenditure of 16 billion in 2022, the R&D expenditure of trams is 3.1 billion.In 2023, perhaps building a car will burn nearly 4 billion yuan of millet.

Buy by buy buy,Xiaomi also invested in the automobile industry chain.

Among the invested companies, there are six power battery companies including Zhongchuang Singapore Airlines, four chip companies including Black Sesame Intelligent, several auto-driving and auto-driving solution providers, and Hesai Technology, which has just rung the bell on Nasdaq, covering the fields of chips, lidar, auto-driving and batteries, in order to break through the technical connection barriers.

Lei Jun, who claimed to invest $10 billion in building cars in 10 years, has repeatedly stressed that Xiaomi is not bad for money.

However, the performance of the main business is now under pressure. In the low tide of global consumer electronics, how Xiaomi will balance cash flow and deal with the "car-making game" of burning money has become the primary problem.

The complexity of the automobile industry is high, the investment is large, the cycle is long, and the fault tolerance rate is low. Blind optimists will only fall down early.

In October last year, Lei Jun made a lofty ambition on Twitter: "The only way for us to succeed is to become one of the top five and ship more than 10 million vehicles every year." However, we must know that in 2022, BYD, which won the sales champion list, will have about 1.86 million transcripts.

And Xiaomi’s core research and development ability in building cars has also been questioned.

According to 36Kr’s report in August last year, Xiaomi decided to use 400V platform+BYD lithium iron phosphate battery for the low-end battery, 800V platform+Ningde Kirin battery for the high-end battery, and UMC and Huichuan for the electronic control, which means that,Xiaomi has not yet had the ability of independent research and development on the key hardware of "Three Electricity", but purchased through Tier1 suppliers.

The newcomers, integrating resources from all sides, want to make a career in the highly involuted automobile industry within three years and become Xiaomi’s next revenue curve. Lei Jun dares to think about it, but does the market dare to believe it?

* Arrangement | Another Ear Review | Hiu