This Spring Festival, Tan Zhu noticed such a set of data:

On New Year’s Eve, with the ringing of the bell at zero o’clock, the Internet Clearing Company and China UnionPay handled the whole industry online payment transaction.Reach peak value, the maximum concurrency is109,000 pens per secondCompared with last year.Increase by 4.61%, ChuangA record high in the same period.

If we look at the time longer, from New Year’s Eve to New Year’s Eve, online payment transactions also achieved rapid growth. The industry-wide online payment handled a total of 15.38 billion transactions, amounting to 7.74 trillion yuan, up 15.8% and 10.1% respectively.

The Spring Festival holiday is coming, and the work of the new year has just begun. What can we find from some hot phenomena of the Spring Festival and the data of the previous two months?

The online payment data during the Spring Festival can reflect the degree of consumption activity to some extent. However, some people will say that the data during the Spring Festival is only a case and does not represent a long-term trend.

If you want to look at it based on the data of the recent period, it may involve an indicator, that is,Narrow money (M1).

Narrow money (M1) generally refers to the sum of cash in circulation and demand deposits of commercial banks, which can be directly converted intoPurchasing power funds.

According to the data of the People’s Bank of China, the balance of narrow money (M1) in January was year-on-year.Increase by 5.9%, the growth rate at the end of last month.4.6 percentage points higher.

In this way, money that can be more directly converted into purchasing power is inincreaseYes. But to explain whether the money is spent or not, we need to introduce more dimensions.Broad money (M2).

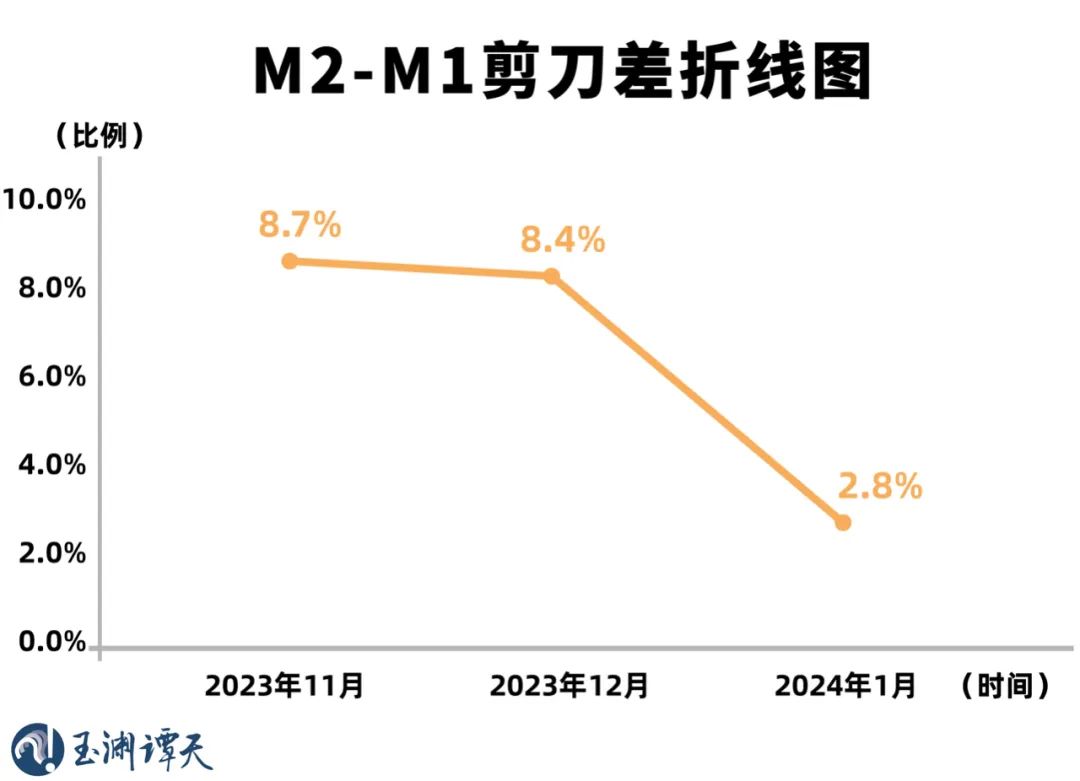

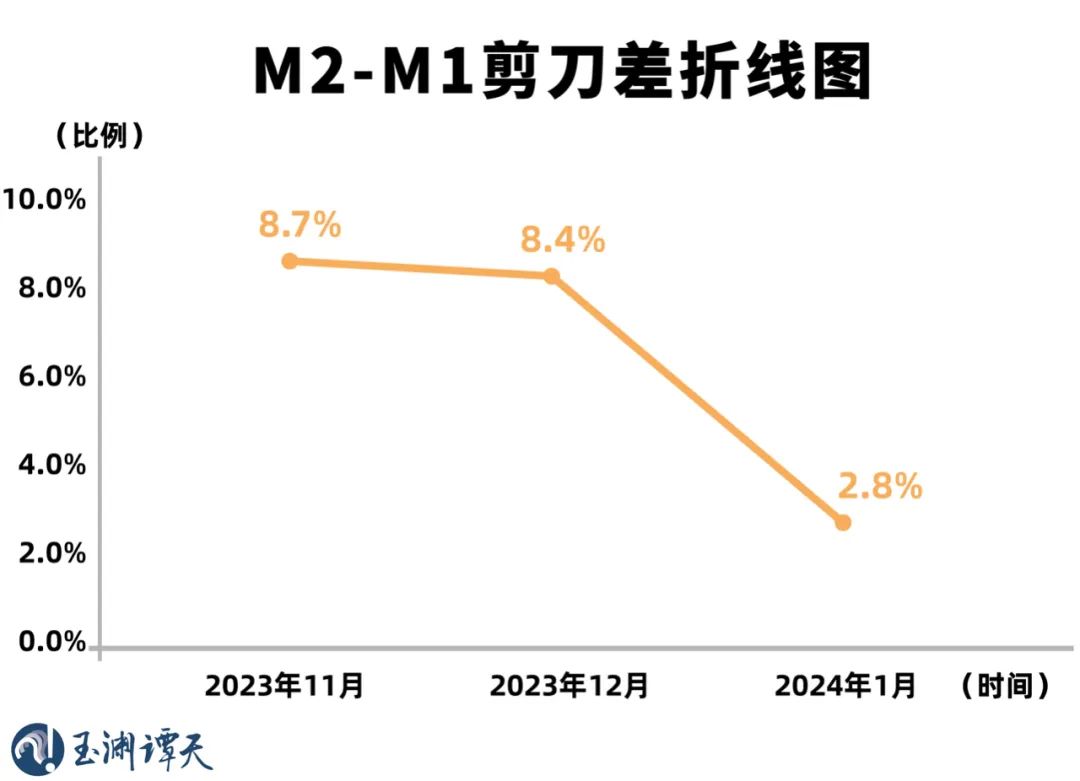

Broad money (M2) is the sum of narrow money (M1) and time deposits of commercial banks. Generally speaking, if the M2-M1 scissors are different.reduceIt means that there is a signal that the activity of micro-subjects has increased and residents’ consumption and corporate investment decisions have become more positive. This in itself can be regarded asMarket confidence recoveryA sign of.

At the end of January, the balance of broad money (M2) was year-on-year.Increase by 8.7%. Calculated, M2-M1 scissors difference is2.8%Compared with the end of last month.8.4%Significantly narrowed.

Specific to the consumption scene, Tan Zhu noticed that this year’s Spring Festival has a new phenomenon that is particularly striking — — Green products and services such as low-carbon travel are popular.

An important reason is that in 2023, China’s automobile sales exceeded 30 million, of which the sales of new energy vehicles accounted for nearly one third. This Spring Festival, many car owners experienced Spring Festival travel rush for the first time. Correspondingly, the need for charging has become particularly prominent.

Tan Zhu noticed that from the early years to the third day of the New Year, the cumulative charging amount of new energy vehicles on the national highways was reached by charging piles.49.9 million kwh.There is a doorway to how much it costs to charge the electricity.

In fact, in the peak period, flat peak period and trough period, the charging cost is different. In some places, the difference between charging 1 kWh during peak period and trough period isAbout 1 yuan. As consumers, everyone wants to charge during the low power consumption period. To achieve this goal, all charging piles need to be digitally and intelligently managed.

This point has now been initially realized.

At present, there are alreadyMore than 1 million charging pilesAccess to the smart car networking platform of the State Grid. Through this platform, it is not only convenient to check all the charging stations on the national highways, but also convenient to control the power of charging piles according to the electricity demand in different regions, so as to promote the peak load cutting and valley filling.

According to the plan of our country, the pilot cities participating in the interactive demonstration of vehicle network should strive toIn 2025, more than 60% of the charged electricity will be concentrated in the low valley..

During the Spring Festival, many people travel long distances, whether traveling or visiting relatives, using electric vehicles. Such a large amount of electricity for travel is a test of intelligent infrastructure. After such a test, the scenes of long-distance travel by electric vehicles in the future are not limited to traveling and visiting relatives.

In fact, whether it is a charging pile or a 5G base station that helps the charging pile realize network interconnection, it has long been a key area of new infrastructure, and these investments have made it today.Digital, intelligent and greenThe consumption scene.

What’s the significance of this new way of traveling to China’s economy?

Take the hot tourism during the Spring Festival as an example. Low cost and convenient travel have promoted tourism consumption. On the basis of January, the tourism consumption data in February will definitely be further improved, and this change will be reflected in the well-known consumer price index (CPI).

However, the data of CPI itself has been used to criticize China’s economy in the past year or two.

Not long ago, the National Bureau of Statistics released monthly data for January, including consumer price index (CPI)There was a year-on-year decline.. Many foreign media use the consumer price index (CPI) as the "biggest decline" in 15 years to show that China’s economy has fallen into "price decline — A vicious circle of reduced consumption.

So how should we view the recent price fluctuations?

Jin Ruiting, an economic expert close to the National Development and Reform Commission, shared a concept with Tan Zhu.Staggered moon effect. CPI in January this yearDecline year-on-yearMainly due to the "wrong month effect" of the Spring Festival.

Because January last year coincided with the Spring Festival, the drive to consumption was more obvious, which made the base of the year-on-year data in January this year originally relatively high and was released during the Spring Festival.consumer demandIt will not be reflected in the data of January this year.

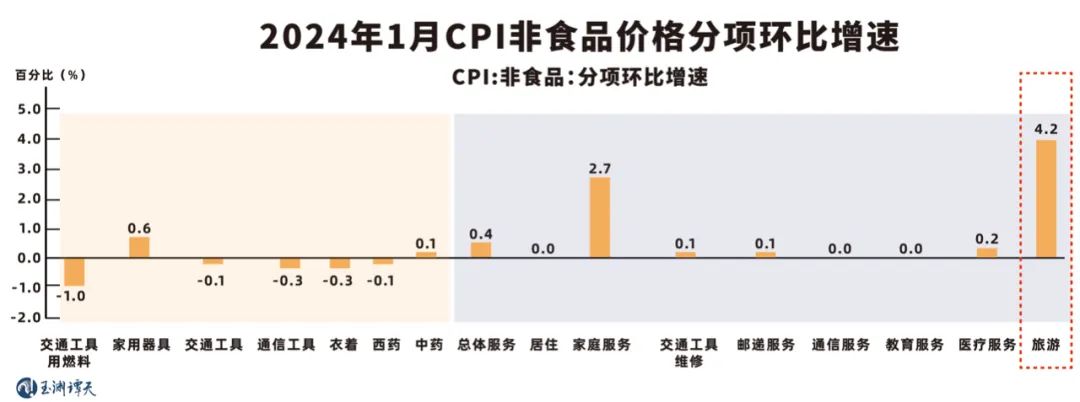

If we disassemble the structure of CPI again, this "wrong month effect" factor will become more obvious.

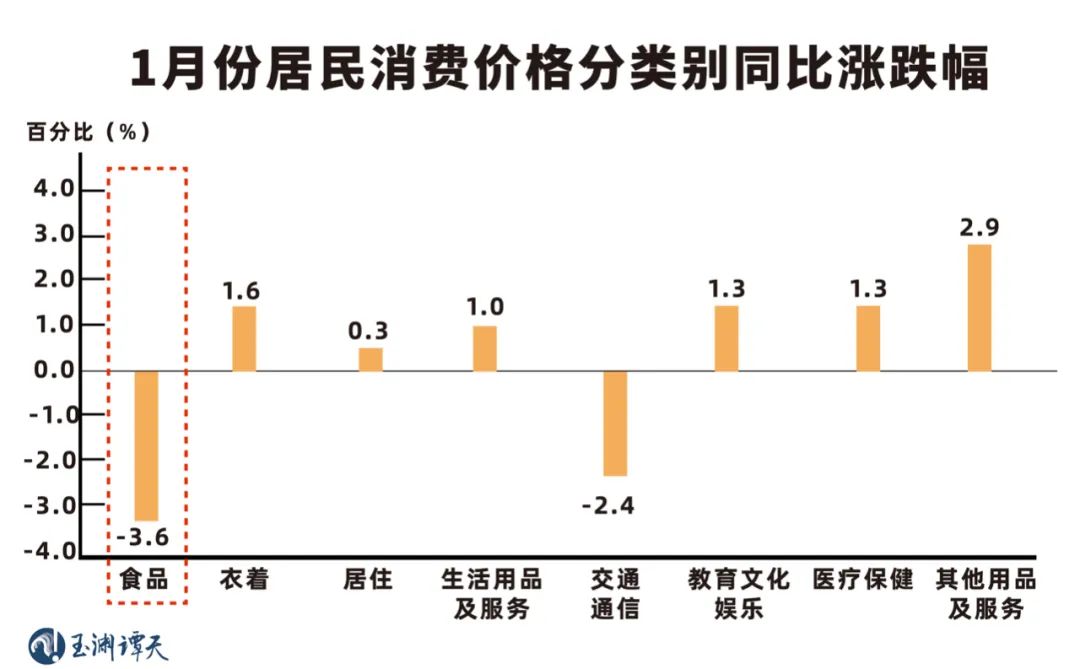

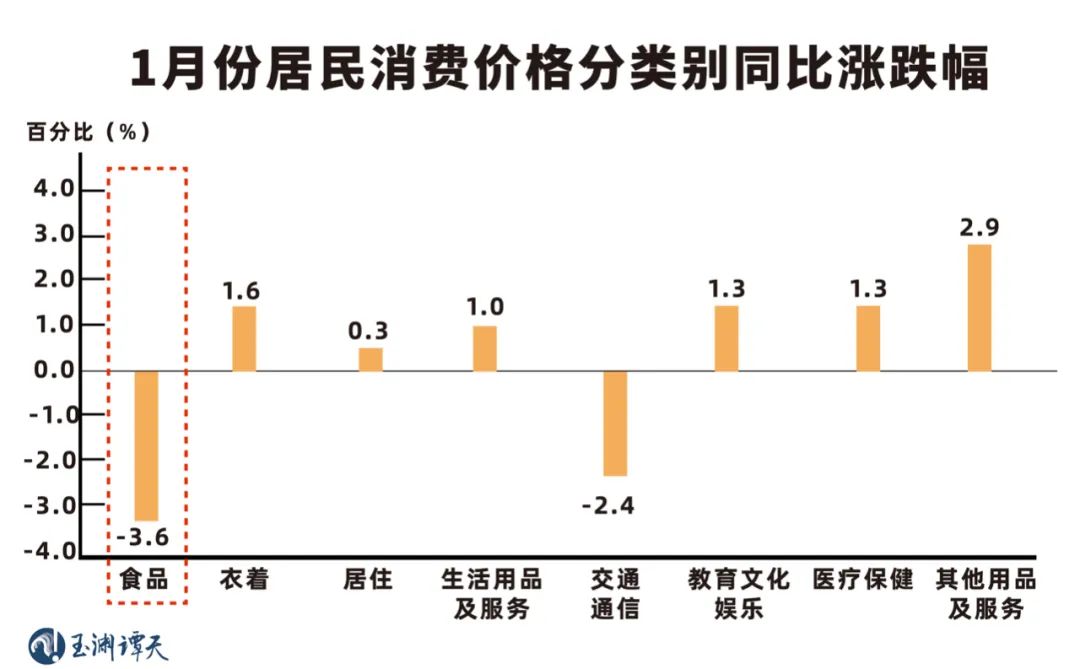

The statistical survey of consumer prices by the National Bureau of Statistics covers food, alcohol, tobacco, clothing, housing, daily necessities and services, transportation and communication, education, culture and entertainment, medical care and other supplies and services consumed by urban and rural residents throughout the country.8 categories, 268Prices of basic categories of goods and services.

The year-on-year decline in January was mainly concentrated infoodThis category, due to the food price.seasonal variationOften larger, the gap between holidays and non-holidays will be very obvious.

But in addition to food, in fact,Prices of industrial consumer goods and servicesAre maintained atmoderateriseInterval.

In the CPI data statistics, the National Bureau of Statistics will also specifically calculate the amount after deducting food and energy.Core CPITo better measure.Long-term price trend. In January, after deducting food and energy, the core CPI dataThe increase is equivalent to the average level of the same period in the past decade..

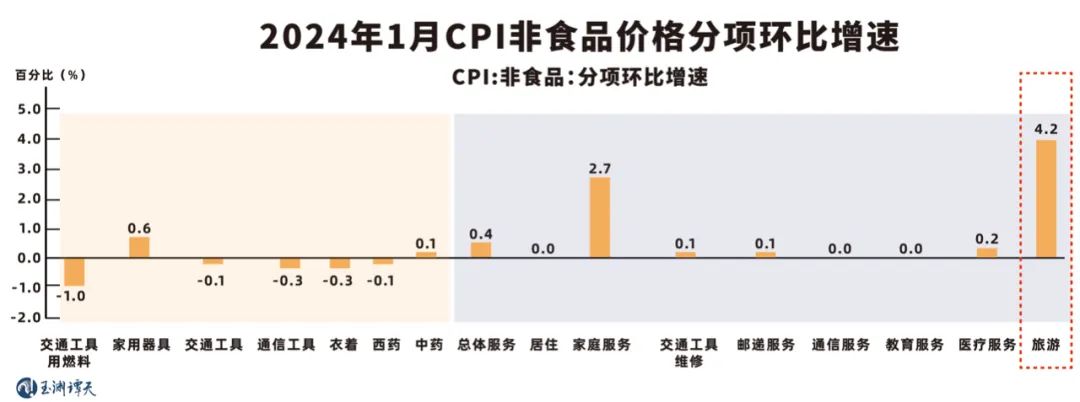

Further analysis, compared with the year-on-year data, CPI ring-on-ring data can more intuitively reflect theShort-term trend.

January CPI dataUp 0.3% from the previous monthIn the short term, it is also in a reasonableModerate rising range.

Relevant professionals told Tan Zhu that when looking at the CPI data in January, we should also consider the decline in pork prices.Periodic factorAnd the decline in oil prices.Input factor. In addition, we should also consider the disturbance factors of traffic breakdown. With the peak in Spring Festival travel rush in February, it is expected that the CPI will also change.

Any data should be placed intrend, only has the meaning of interpretation.

Looking at the cycle of the past year, the overall CPI data of China is still inPositive intervalOverall, it showed a moderate increase and did not fall into a continuous decline.

China’s CPI data, regardless of horizontal ratio, vertical view, or disassembly, areUnable to inferThe so-called "overall decline in prices" trend.

The so-called "price drop — The vicious circle of consumption reduction is even moreDidn’t appear. Per capita consumption expenditure of consumers in China in 2023Increase by 9%, the national per capita service consumption expenditure growth.14.4%.

On the whole, China’s domestic demand will be there throughout 2023.Recover graduallyAmong them.

In 2023, the total retail sales of consumer goods in China reached47.1 trillion yuanScale of investment in fixed assets50.3 trillion yuanThe contribution rate of domestic demand to economic growth has reached111.4%, higher than last year.25.3 percentage points.

Since the CPI data of China is generally stable, why are there always some voices saying things with this indicator?

Analysis of some American and Western media reports on the fluctuation of CPI data in China this year shows that the main conclusion it points to isChina’s economy is in deflation..

Jin Ruiting has a persistent concern about the concept of "deflation". He mentioned that in the definition of western economics, there are usually several indicators to judge whether an economy is in "deflation":

||First, the overall price level has declined.

||Second, the money supply has decreased.

||Third, with the economic recession.

Usually, these three phenomena appear at the same time, and it is judged that there has been "deflation". But according to the above, in China, these three situations arenon-existent.

Since the "deflation" mentioned by these foreign media is not a definition that conforms to economic logic, what is the purpose of choosing the concept of "deflation" to continuously shape China’s economy?

Tan Zhu extracted the theme of foreign media reports on China’s economic "deflation" since 2023, among which a technical term — —"balance sheet recession".

This is the foreign media’s "deflation" in the past year.Mention togetherA new word, but the word itself has appeared for many years.

Going forward, it goes back to the 1990 s. At that time, the debt backlog caused by the bursting of Japan’s economic bubble made Japanese people and enterprises tighten their wallets, even if the bank interest rate dropped to zero, they could not get interest.I just want to save money or pay my debts first.Not to mention spending money on consumption and investment.

Faced with this phenomenon, economist Gu Chaoming put forward the concept of "balance sheet recession" after Japan’s economic bubble burst, describing the residents andEnterprises are insolvent, and they only save and don’t spend.— — "Insufficient demand" toextremeA state of being.

In this state, a country’s central bank’s macro policies, such as lowering interest rates or increasing money supply, will almost be ineffective and can only be adopted.Structural reform of the economic systemIt is possible to get rid of such a situation.

Relevant professionals told Mr. Tan that the significance of discussing "deflation" is not its definition, but what really matters is.Policy implications behind different definitions.

This is exactly whatRecognize the narrative of "deflation"The core of.

Now foreign media apply the concept of "balance sheet recession" and "deflation" to China’s economy. An important purpose is to ask China to follow the "prescription" prescribed by the United States and the WestTransform one’s own economy, especially want to use the so-called "lessons" to tell China:

China’s economic model is not good and must be changed — — Don’t waste time on long-term transformation and upgrading unless you take immediate action."Water release" to stimulate the economyOtherwise, it will follow Japan’s footsteps.

However, more than one economic expert who has studied the concept of "balance sheet recession" has mentioned it to Tan Zhu.There are huge differences between China and Japan, and related concepts cannot be directly applied..

At present, there are three factors in China’s economy that do not meet many important characteristics of "balance sheet recession":

||China’s economy is still there.Maintain recovery growth, did not fall into recession;

||Total credit and social financingStill keep growing;

||The government’s debt ratio is still atSafety level.

So how should we understand China’s logic of adjusting its own economic operation rhythm?

Dong Yu, a Tsinghua University scholar who has participated in many five-year plans, has learned from oneA longer-term perspectiveMade a review.

Historically, China has also experienced similar data fluctuations before, one of which is 2012-2016, during which another indicator to measure the price level is the industrial producer ex-factory price index (PPI).Negative for 54 consecutive months, the lowest-5.9%, but CPI is still positive.

After this happened, China didn’t choose to "throw money" directly. Dong Yu told Master Tan that the way China took wasSupply-side structural reform.

Specifically, we corrected the price signal and realized PPI by reducing the cost of the real economy and accelerating the cultivation of high-tech industries and strategic emerging industries.From negative to positive.

We didn’t choose to treat a headache, but exerted our strength on the supply side.Transition to high-quality development. This way may not be the fastest, but the problem can be solved for a long time.

This transformation effort is reflected in the field of money and finance, that is,Quality improvement and optimization of credit supply structure.

Since 2018,Pratt & Whitney Small and Micro Loans, Medium-and Long-term Loans for Manufacturing Industry, and Green LoansThe constant growth rate continued to be higher than the growth rate of all loans, while the growth of traditional kinetic energy loans such as real estate and local financing platforms slowed down and the proportion gradually declined.

Financial institutions continue to increase their support for major strategies, key areas and weak links.Supply-side structural reform matching the production end.

In recent years, we can feel that the country has been emphasizing.Support the real economy and technological innovation.

This kind of support is to form production capacity and products that meet the development direction and market demand, and to give consideration to both the present and the long-term, create long-term effects through investment, and achieve a high-level balance between demand pulling supply and supply creating demand.

Because of this, we can see that investment is constantly shifting to strategic emerging industries.

In 2023, central enterprises completed the investment in strategic emerging industries.2.2 trillion yuan, year-on-year growth32.1%。

The investment in new energy has increased over the same period last year.34%.

Matching with it, we have seen that the investment direction of green, intelligent and digital is changing into a new consumption trend that pursues green health, scientific and technological intelligence and diverse personality.

After reading these analyses, let’s recall the "argument" that sings down China’s economy. No matter whether it is "having money and not spending it" or the so-called "deflation" in China’s economy, it can’t be.Fact levelStand still.

becauseRarely go deepUnderstand China, so it will appear that after seeing the fluctuation of individual indicators,"Listening to the wind is rain"The situation.

What we have to do isIn wind and rain these mansions would stand like mountains high, is staring at the goal, at the problem, continue to take your own path, continue to do your own thing. No matter how high the mountain is, if you climb it, you will always reach the top; No matter how long the road is, if you go on, you will definitely arrive!